‘The risk profile of the index increasingly reflects the fortunes of those companies rather than the broader U.S. economy,’ one economist said.

Illustration by The Epoch Times, Oleksii Pydsosonnii/The Epoch Times

|

Updated:

Many investors opt for index funds in the belief that, by doing so, they are diversifying their risk across a broad segment of companies and industries. Increasingly, however, that is no longer the case.

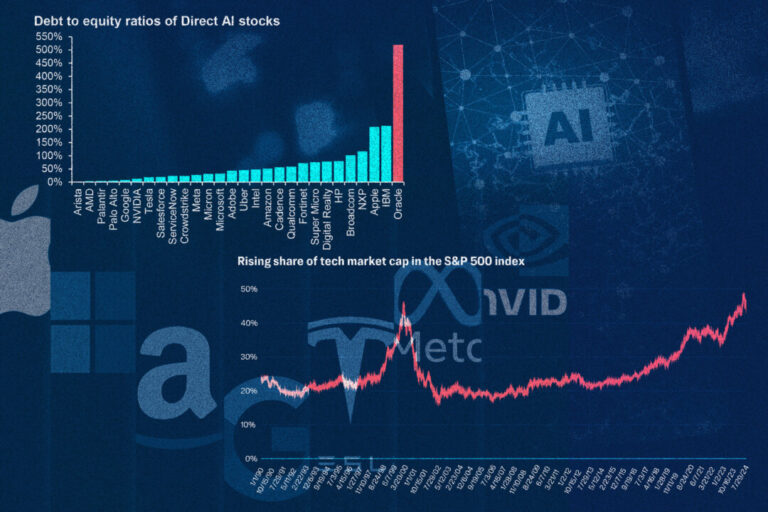

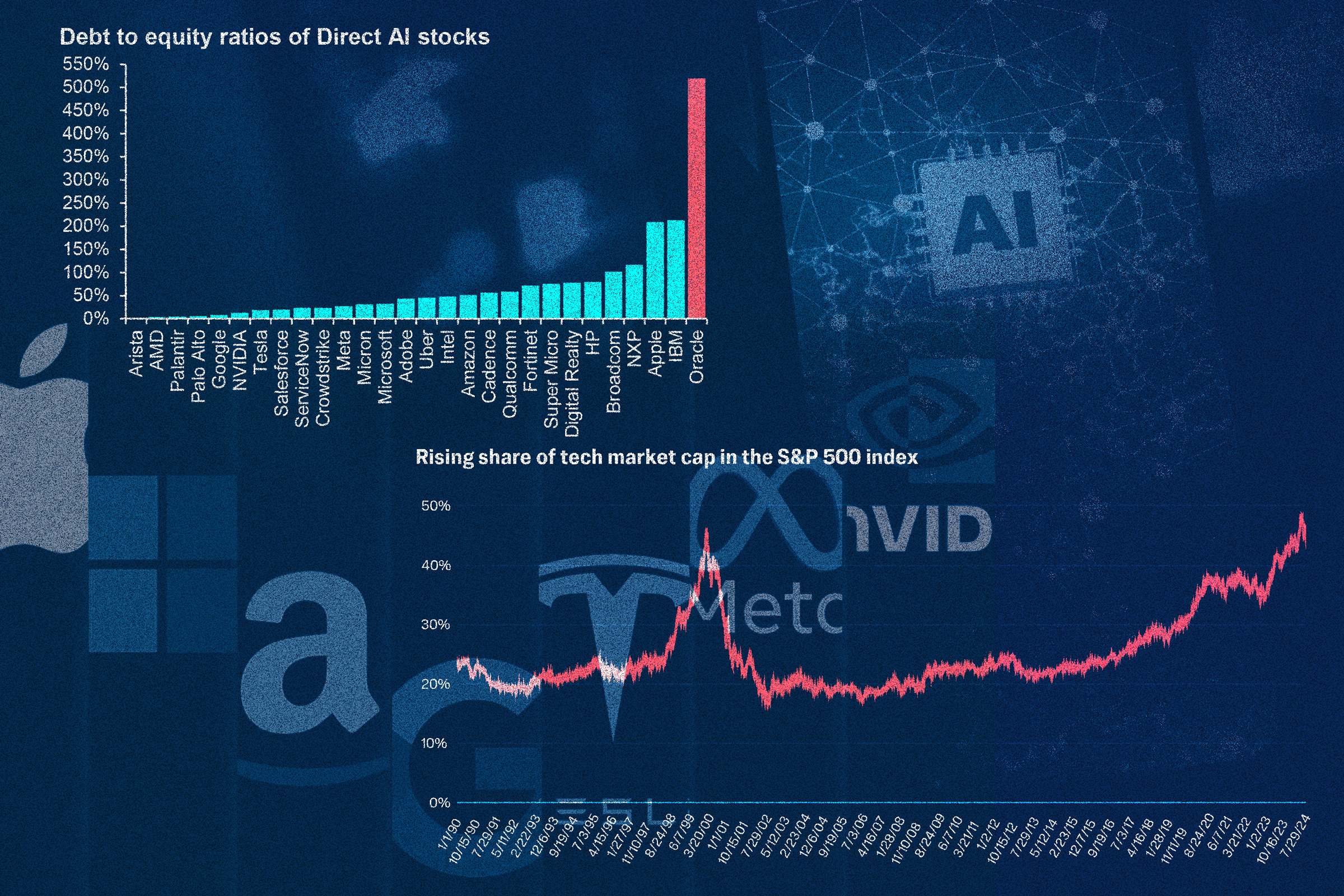

Companies involved in information technology or communication services now comprise about 43 percent of the S&P 500 index by market capitalization, according to a September report by U.S. Bank Wealth Management. Seven tech companies alone—the so-called “Magnificent Seven” of Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—now represent about 36 percent of the total market cap of the index, up from a 12 percent share in 2015.